What all life sciences start-ups should know about fundraising

Share this article

The Biopôle campus in Lausanne brings together some of the world’s most innovative life sciences companies. But how does an organisation make the leap from ambitious start-up to major multinational? Here are some fundraising tips from Distalmotion and SEED Biosciences, established members of the Biopôle’s community.

Focus on sales and revenue

Many start-ups concentrate on raising capital, but fundraising will be more effective if a company can demonstrate success. One of the main indicators of a sound investment is strong revenue growth. So, rather than trying to perfect the best prototype or solution, the main aim should be to sell something as soon as possible. This could be anything – from consulting hours to a pilot scheme that gets the product into clinical use. It just requires some creativity to generate a cash flow and make the company attractive to investors.

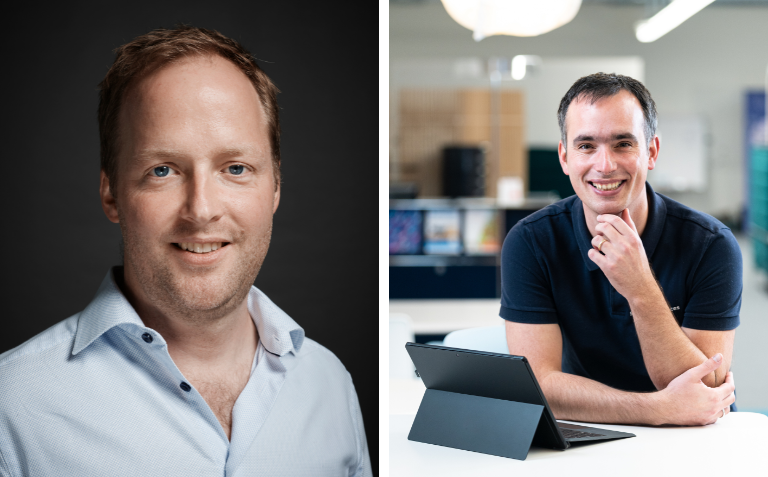

As Georges Muller, CEO and Co-Founder of SEED Biosciences, explains: “The basic equation is as follows: focusing on sales and revenue will beget investment. This, in turn, will support the company’s growth. There’s no better reassurance for an investor than to see a company’s revenue is growing.”

Establish good relationships with investors

Successful fundraising is about more than presenting a strong business plan. It also involves building trust and rapport, establishing open lines of communication and being transparent with investors. This can be achieved by seeking to understand their motives for investing, acting on feedback and sending regular updates.

Michael Friedrich, COO of Distalmotion, explains that investors need to feel confident that the people behind the venture have the knowledge, drive and passion to make it a success: “It’s not just about the figures. They can look at very attractive investment opportunities, but if they don’t have a good gut feeling about the team, they won’t invest. They need to trust the people. Intuition is an important factor that is sometimes overlooked when studying an Excel spreadsheet.”

Investors have more than money to offer entrepreneurs. As business experts, they are likely to bring a wealth of experience and a network of contacts. Forging strong relationships can give start-ups direct access to this support.

Build credibility to validate the venture

A start-up that lacks credibility will struggle to attract investment. Distalmotion and SEED Biosciences have used a combination of tactics to build their reputations.

For SEED Biosciences, this involved forming a partnership with Molecular Devices, an established brand. “It helped with our visibility. One of the biggest obstacles for start-ups is the lack of visibility and credibility. Yet in life sciences, credibility is key,” said Georges Muller.

Distalmotion has sought to validate its business in several ways – from appointing the Chairman of its lead investor as Distalmotion’s Chairman, to choosing a dynamic, reputable location like Biopôle. It has also carefully positioned itself from the beginning. “Credibility is an important aspect of our brand, so that’s why we never called ourselves a start-up in the early days. We called ourselves a medical device venture,” said COO, Michael Friedrich.

For more fundraising tips and insights, read Biopôle’s stories shared by Michael Friedrich and Georges Muller, on which this article was based.

Source: Biopôle

Top fundraising rounds in 2023 at Biopôle

It has been another successful year for Biopôle-based life sciences companies. The following organisations have raised significant funds:

- Distalmotion raised US$150m to accelerate FDA approval for Dexter, its robotic surgery device.

- NewBiologix received US$50m to advance a technology platform used to manufacture gene and cell therapies.

- Epiterna secured €10m to develop drugs that could help pets and people live longer and healthier lives.

- Atinary Technologies accessed US$5m to deploy its machine learning platform at scale.

- Novostia raised an additional €2.5m to develop a breakthrough artificial heart valve.

- Limula SA received €2.5m in non-dilutive funding to fast-track the industrialisation of a solution for cell and gene therapy manufacturing.